During the meeting September 21, the Southlake City Council approved the budget for FY 2022. The new budget year starts October 1, 2021.

The proposed operating budget totals $104.6 million and includes a 1.5 cent tax rate decrease, reducing the total rate to $0.390. The tax rate reduction means a revenue reduction to the City of $1.23 million.

Southlake’s 20% homestead exemption continues for FY 2022, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an approximate eight-cent tax rate reduction.

The City Council has worked strategically for meaningful tax relief for homeowners, managed with the consideration that as Southlake continues to grow, and infrastructure will need to be created and maintained. View a timeline of tax relief initiatives.

The City’s budget funds everyday services such as fire response, police protection, drinking water, wastewater and streets to go from place to place. But the budget also goes beyond basic services to support the quality of life for those who live, work and play in Southlake such as beautiful parks and open spaces, recreation opportunities and programs for everyone.

The City of Southlake strategically plans each year with a balanced budget, directing resources to areas essential to the community’s wellbeing. We know these services and activities are important because our citizens tell us what matters to them through the biennial Citizen Satisfaction Survey, customer feedback and discussions with staff and elected leaders.

Learn more about the FY 2022 budget at www.CityofSouthlake.com/FY2022. Learn more about our budgeting process at www.CityofSouthlake.com/AllAboutTheBudget.

The proposed FY 2022 Budget has been submitted by City Manager Shana Yelverton to the City Council for consideration.

The proposed operating budget totals $104.6 million and includes a 1.5 cent tax rate decrease, reducing the total rate to $0.390. The tax rate reduction means a revenue reduction to the City of $1.23 million.

Southlake’s 20% homestead exemption continues for FY 2022, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an approximate eight-cent tax rate reduction.

Southlake’s 20% homestead exemption continues for FY 2022, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an approximate eight-cent tax rate reduction.

“For more than a decade the City Council has delivered on our continued promise of providing tax relief,” Mayor John Huffman said. “This tax rate reduction gives an extra boost to our residents with the continued 20% homestead exemption. Everyone understands that appraisals are constantly going up, so to have a new tax rate that’s below the effective rate, and still offer the 20% homestead exemption to our residents, is important to the families that call Southlake home.”

The City Council has been working strategically for meaningful tax relief for homeowners, managed with the consideration that as Southlake continues to grow, and infrastructure will need to be created and maintained. View a timeline of tax relief initiatives.

How did the City come up with this budget?

Throughout the fiscal year, in preparation for the budget, staff monitors several data sources to help project revenue. Using data from the residential and commercial sectors, employment numbers, consumer spending, and the impact from COVID-19, staff analyzes various economic scenarios to make financial projection decisions accordingly.

In spring 2021, departments begin preparing for the FY 2022 budget. Using a modified zero-based budget process, department directors prepare plans to fund the services the city will offer. Proposed expenses are carefully vetted before they are included in the budget proposal.

As a practice, the City limits operation budget growth to a benchmark reflective of the consumer price index. This means the cost of existing services shouldn’t exceed the cost growth of services in DFW. For FY 2022, the proposed General Fund budget growth is 2.4%.

More information about the budget process and assumptions can be found in the Budget Overview section of the FY 2022 Proposed Budget.

What is included in the budget?

What is included in the budget?

The budget includes project recommendations from the comprehensive plan and prioritizes Capital Improvements Plan (CIP) projects according to the Master Plans and the City’s ability to fund them. Cash will be used to pay for most of the important capital improvement projects. The City will issue bonds to supplement cash payments.

The amount budgeted for capital projects is $32.8 million. Planned capital improvement projects include improvements for sidewalks, drainage, parks projects like the Southlake Sports Complex improvements, as well as traffic and intersection safety initiatives. Additionally, this budget sets aside funding for the Municipal Service Center and Public Safety Training Tower.

The conservative budget sets up Southlake with an eye towards the future given the COVID-19 pandemic while maintaining essential services like streets, water and sewer, as well as envisioning other projects to make Southlake the ideal place to live, work and play. A full overview of the FY 2022 budget can be found in the Transmittal Letter section of the FY 2022 Proposed Budget.

What about reducing debt?

The total debt fluctuates depending on projects funded during the year. Since 2010, the City’s property tax-supported debt has been reduced by 78%. The remainder of the current property tax debt obligations will be paid off in less than ten years.

“This is an important gauge of the City’s fiscal health and an important indicator that bond rating agencies review when determining the rating they will assign to city debt,” Chief Financial Officer Sharen Jackson said.

The debt reduction prepares the City to handle projects that will require bonds in the future, such as a new library, a potential open space program, CIP projects, and updating aging infrastructure.

Is the City dipping into savings to pay for operations?

Is the City dipping into savings to pay for operations?

Structural balance is a guiding principle to budget creation in Southlake. The City does not draw down from its reserves to pay for operating expenses and projected revenue must cover all planned expenses. Through this mindset, the City has paved the way to achieving optimum reserves and exceed the optimum fund balance to create an opportunity to pay cash for large projects.

What about providing quality services?

The outlined budget aims to continue the Southlake tradition of quality services not only with projects but with hiring and keeping world-class employees. Even with a tax reduction, the City of Southlake does not anticipate pay cuts, layoffs, or service reductions.

The proposed budget ensures the City of Southlake retains and recruits world-class employees. Under the General Fund accounts, more than 70% goes toward labor-related costs. This includes compensation and benefits that are market competitive but holds the line on costs. In 2022, the City proposes a cost of living adjustment of 2.5%, as well as a merit increase of 0-2% consistent with the City’s policy on compensation.

What’s the financial plan during so much economic uncertainty?

Most importantly, the budget is sustainable for the future.

Following the financial guiding principles positions the City for budget stability, even during difficult economic times.

“The decisions we make today affect our financial situation in the future,” City Manager Shana Yelverton said. “We must continue to provide outstanding service to the community today and ensure that we can cover these costs down the road.”

Learn more about the FY 2022 budget at www.CityofSouthlake.com/FY2022.

Want to see an upgrade to the library, recreation programs or your neighborhood sidewalks and parks?

The City’s budget funds everyday services such as fire response, police protection, drinking water, wastewater and streets to go from place to place. But the budget also goes beyond basic services to support the quality of life for those who live, work and play in Southlake such as beautiful parks and open spaces, recreation opportunities and programs for everyone.

The City of Southlake strategically plans each year with a balanced budget, directing resources to areas essential to the community’s wellbeing. We know these services and activities are important because our citizens tell us what matters to them through the biennial Citizen Satisfaction Survey, customer feedback and discussions with staff and elected leaders.

The city manager files the budget each year on August 15. The City Council provides direction, reviews the budget, and once voted on and approved, the City’s plans are funded for the next fiscal year from October 1 to September 30.

But planning for the budget begins long before that. Many times, plans for the next fiscal year begin in October. Each budget shows the financial plan for how tax dollars are being put to work and what services and programs citizens want prioritized for funding.

Together, with guidance from citizens, we can envision and create the best Southlake.

Want to learn more about the budget? Visit www.CityofSouthlake.com/AllAboutTheBudget.

To help pay for a community’s essential services or build facilities for your enjoyment, cities sometimes borrow money.

Just like you might take out a loan to pay for your home, the City of Southlake might accrue debt for capital projects. Issuing bonds allows the City to spread the cost over several years.

However, we never borrow money to pay for daily operations. Over the past several years, the City has opted to pay cash for projects and limited its use of property-tax supported bonds. Some projects are paid for with special funding approved by voters for a specific purpose.

Property taxes are used to pay off City debt for things like roads and sidewalks. The total debt fluctuates depending on projects funded during the year and payments. Since 2010, the City of Southlake has reduced its tax-supported debt by 69%. The remaining property tax debt obligations will be paid off in less than 10 years.

“Many years ago, we made the decision to reduce property tax supported debt,” said CFO Sharen Jackson. “We’ve worked our plan by using cash for projects, refinancing when market conditions were favorable and amortizing the debt over short periods of time. This has allowed us to reduce the tax rate dedicated to debt, even while we are planning for future infrastructure investments.”

Conservatively managing the amount of bonds issued prepares the City to handle projects that might require bonds in the future, like a new library, an open space acquisition program, updating infrastructure or other large capital projects.

Through using debt responsibly and our excellent financial management, the City has a AAA rating from both Fitch and S&P.

More information about how we manage debt and a deep dive into how to review the current status of the City’s outstanding bonds is available on our website.

Learn more about the City of Southlake’s financial plan for FY 2021 by reviewing the proposed budget.

The proposed FY 2021 Budget has been submitted by City Manager Shana Yelverton to the City Council for consideration.

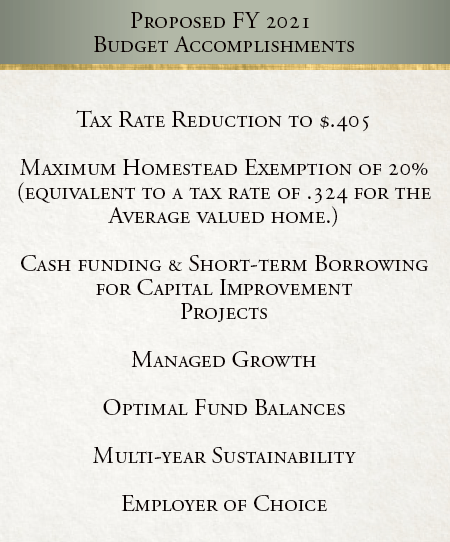

The proposed budget totals $105.2 million and includes a ½ cent debt tax rate decrease, reducing the total rate to $0.405. The tax rate reduction means a revenue reduction to the City of $388,500.

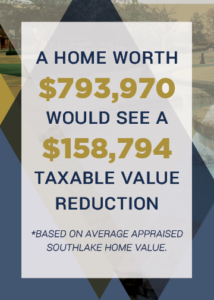

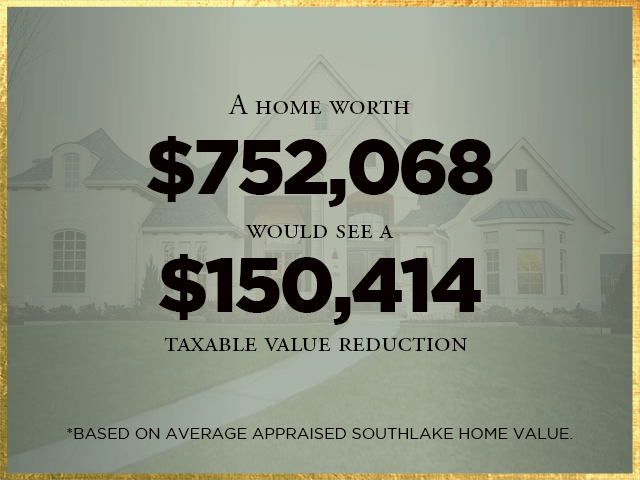

Southlake’s 20% homestead exemption continues for FY 2021, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an 8.1 cent tax rate reduction.

Southlake’s 20% homestead exemption continues for FY 2021, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an 8.1 cent tax rate reduction.

“Several years ago, the Council set tax cuts for our citizens as a goal,” Mayor Laura Hill said. “At the end of the day, our taxpayers expect us to manage tax dollars responsibly and it is important that the City is a good steward and using the funds for the betterment of the community.”

The City Council has been working strategically for meaningful tax relief for homeowners, managed with the consideration that Southlake continues to grow, and infrastructure will need to be created and maintained. View a timeline of tax relief initiatives.

How did the City come up with this budget?

Chief Financial Officer Sharen Jackson presented the FY 2021 Budget Guiding Principles at the August 4 City Council meeting, sharing the strategy map to deliver on six focus areas: Safety and Security, Mobility, Infrastructure, Quality Development, Partnership and Volunteerism and Performance Management and Service Delivery. Watch the presentation.

“In preparation for the budget, I look at several data sources to help project revenue,” Jackson said. “Using data from the residential and commercial sectors, employment numbers, consumer spending, and the impact from COVID-19, I analyze various economic scenarios to determine what we can expect in the future and make financial projection decisions accordingly.”

Using a modified zero-based budget process, department directors prepare plans to fund the services the city will offer. Proposed expenses are carefully vetted before they are included in the budget proposal.

What is included in the budget?

What is included in the budget?

The budget includes project recommendations from the comprehensive plan and prioritizes CIP projects according to the Master Plans and the City’s ability to fund them. Cash will be used to pay for most of the important capital improvement projects. The City will issue short-term bonds to supplement cash payments.

The amount budgeted for capital projects is $13.7 million. Planned capital improvement projects include improvements for drainage, parks projects like the Southlake Sports Complex improvements, as well as traffic and intersection safety initiatives.

The conservative budget sets up Southlake with an eye towards the future given the COVID-19 pandemic while maintaining essential services like streets, water and sewer, as well as envisioning other projects to make Southlake the ideal place to live, work and play.

What about reducing debt?

The total debt fluctuates depending on projects funded during the year. Since 2010, the City’s property tax-supported debt has been reduced by 69%. The remainder of the current property tax debt obligations will be paid off in less than ten years.

“This is an important gauge of the City’s fiscal health and an important indicator that bond rating agencies review when determining the rating they will assign to city debt,” Jackson said.

The debt reduction prepares the City to handle projects that will require bonds in the future, such as a new library, a potential open space program, CIP projects, and updating the aging infrastructure.

How is the City managing expense growth?

As a practice, the City limits operation budget growth to a benchmark reflective of the consumer price index. This means the cost of existing services shouldn’t exceed the cost growth of services in DFW. For FY 2021, the proposed General Fund budget growth is 1.5%.

Is the City dipping into savings to pay for operations?

Structural balance is a guiding principle to budget creation in Southlake. The City does not draw down from its reserves to pay for operating expenses and projected revenue must cover all planned expenses. Through this mindset, the City has paved the way to achieving optimum reserves and exceed the optimum fund balance to create an opportunity to pay cash for large projects.

What about providing quality services?

The outlined budget aims to continue the Southlake tradition of quality services not only with projects but with hiring and keeping quality public servants. Even with an estimated revenue reduction, the City of Southlake does not anticipate pay cuts or layoffs.

The proposed budget ensures the City of Southlake retains and recruits world-class employees. Under the General Fund accounts, about 70% goes toward labor-related costs. This includes compensation and benefits that are market competitive but holds the line on costs. In 2021, the City proposes a cost of living adjustment of 1.5% consistent with the City’s policy on compensation.

What’s the financial plan during so much economic uncertainty?

Most importantly, the budget presented is sustainable into the future.

Following the financial guiding principles positions the City for budget stability, even during difficult economic times.

“The decisions we make today affect our financial situation in the future,” Yelverton said. “We must provide outstanding service to the community while balancing our ability to pay in the coming years.”

Learn more about the FY 2021 budget at www.CityofSouthlake.com/FY2021.

City of Southlake CFO Sharen Jackson provided a financial outlook during the May 19 City Council meeting.

Just like other organizations around the world, COVID-19 has impacted the City’s finances and operations. Two key revenue streams for the City of Southlake have been significantly affected, sales tax and hotel occupancy tax, also known as HOT. Sales tax revenue for March 2020 was down 7% from what was anticipated, while HOT revenue was down 62% from City projections. Sales tax revenue for March reflected a partial month of normal activity. It is anticipated that future collections will be significantly less than projected with the adopted FY 2020 budget beginning with the April report.

“Based on our projections, we probably will not collect any HOT taxes for a while going forward,” Jackson said during the meeting.

In March, the U.S. government passed the CARES Act to help with expense reimbursements, however this does not provide for revenue loss relief.

The State of Texas received $11.2 billion in CARES Act funds, with Tarrant County receiving more than $200 million in direct funding. The City expects to receive some of the funds delivered to Tarrant County as part of an interlocal agreement at an estimated rate of $55 per capita.

Jackson reminded the Council during the meeting that the City has the right to request these funds, but that funding is not guaranteed. These funds are required to be used as a reimbursement of costs due to COVID-19, but are not for replacing revenue lost due to decreases in sales, hotel and other taxes.

The City could also receive funds from Denton County for the small percentage of the city limits located in the county.

Jackson said the City will also apply for other government program grants to make up for any funding gaps. She anticipates a slow economic recovery period before sales and hotel tax revenue improves.

City Manager Shana Yelverton is expected to propose an amendment to the fiscal year 2020 budget in June to offset the decrease in revenue. This will be paired with reduced expenses and programming to balance the City’s budget.

To address the potential of decreased revenue, the City froze travel and hiring in March, as well as furloughed 150 employees in April. Large projects were deferred to stabilize the budget. Some community events were also canceled.

Yelverton will propose an FY 2021 budget that takes into consideration decrease revenues of sales and hotel taxes, as well as decreased revenue received from property taxes due to an expected rise in owners protesting property values.

“Early on, we made decisions to address any potential for decreased revenue so we could continue to make sure Southlake is a great place to live and work,” Yelverton said.” “We applied fact-based decision making and management best practices so that we remain good stewards of the funds we’ve been entrusted with. These decisions aren’t always easy, but they’re in the best interest of moving the City forward and responsibly managing our budget.”

Jackson said there are ongoing discussions on the federal level of additional legislation to appropriate revenue replacement funds for local governments.

“We went through our financial audit two months ago and we had fund balances even in excess of the stated goal of 25%,” Mayor Pro Tem Shawn McCaskill said. “Fortunately, we’ve been saving our pennies in the good times to cushion the blow in the bad times.”

During the meeting, Southlake Mayor Laura Hill discussed the perfect timing of previously approved tax breaks for Southlake.

“We also had a tax rate decrease in the current year. That was a tax break for all of our homeowners and also our businesses,” she said. “On top of that, we did the 20% homestead exemption for our residents.”

The City’s principles of planning ahead set the City to be on a good path by saving funds for a rainy day. The consistent planning and constant vigilance of the City’s staff and City Council will ensure that Southlake is prepared for what the future holds in a post-COVID-19 world. Watch the full presentation and Council meeting here.

The quietness of Southlake Town Square is unsettling as shoppers and workers stay at home to ride out the coronavirus threat. A once busy mecca for shopping and dining, stores and offices are now dark, and restaurants only serve the occasional curbside customer. Although she doesn’t doubt that the energy will return to the Square and other areas of the City’s economy, Southlake’s Chief Financial Officer, Sharen Jackson, understands that the fiscal situation has changed significantly and is already taking steps to ensure that the City’s financial position is not compromised by the challenging situation.

“When the situation started to unfold, we took immediate steps to alter our spending,” Jackson said. “Initially, we froze hiring, halted certain capital projects, and eliminated travel.”

Since then, City staff has taken additional steps to cut costs and plan for a somewhat uncertain future. Most recently, 150 part-time employees were furloughed. Most of these employees were providing recreation services at Legends Hall and Champions Club.

“Staff has been working to make strategic decisions about how to prudently move forward in the changed economy,” said Mayor Laura Hill. “The City Manager plans to soon bring a budget amendment and other financial recommendations for Council consideration.”

The budget amendment will reflect reduced revenue projections, and any needed changes to planned spending for capital projects, operations, and personnel to maintain financial integrity for FY 2020.

“We are going to need to reconsider our multi-year perspective and consider how our choices could affect our AAA bond rating,” said Shawn McCaskill, Mayor Pro Tem. “New circumstances dictate a reconsideration of our priorities. For example, this is probably not the time to move forward with the much-discussed bond program for open space. Some important initiatives are probably just going to have to wait.”

In addition to retooling the City’s financial plans, staff is also working to identify eligibility for federal or state funding and potential tools for helping the community get back on its feet.

“I’ve asked Councilmembers McCaskill and Huffman to oversee our recovery effort,” said Mayor Hill. “It’s too early to know exactly what form it will take, but we’re open to considering anything that will restore Southlake to its pre-virus form.”

Deputy Mayor Pro Tem John Huffman agrees. “We’ve already started connecting local businesses to resources that may make a real difference for them. We’re committed to doing what we can to help with finances, regulations, or other challenges so that our community comes out of this experience stronger.”

For Jackson, the challenge exists but isn’t insurmountable. “We’ve always planned conservatively. That will serve us well in this moment as we reconsider our approach.”

Although many operational steps are already being taken to limit spending, Mayor Hill expects the formal budget discussions to occur in late May or early June.

“The Council has always done an excellent job of working with staff to manage the City’s finances, and we’ll continue to do so. We’ll be taking the same approach we always have, carefully balancing the desire for excellent service with taxpayer interests,” she said.