The proposed FY 2021 Budget has been submitted by City Manager Shana Yelverton to the City Council for consideration.

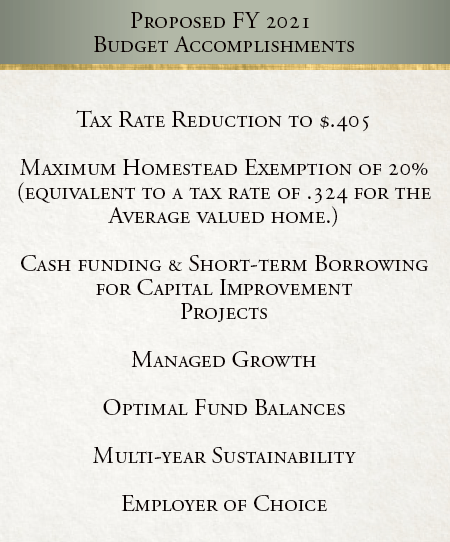

The proposed budget totals $105.2 million and includes a ½ cent debt tax rate decrease, reducing the total rate to $0.405. The tax rate reduction means a revenue reduction to the City of $388,500.

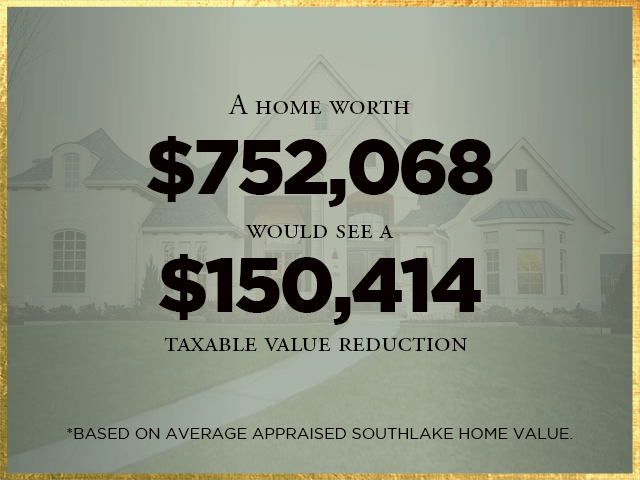

Southlake’s 20% homestead exemption continues for FY 2021, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an 8.1 cent tax rate reduction.

Southlake’s 20% homestead exemption continues for FY 2021, the highest amount allowed by law. The 20% homestead exemption means homeowners of an average-valued home in Southlake will receive the equivalent of an 8.1 cent tax rate reduction.

“Several years ago, the Council set tax cuts for our citizens as a goal,” Mayor Laura Hill said. “At the end of the day, our taxpayers expect us to manage tax dollars responsibly and it is important that the City is a good steward and using the funds for the betterment of the community.”

The City Council has been working strategically for meaningful tax relief for homeowners, managed with the consideration that Southlake continues to grow, and infrastructure will need to be created and maintained. View a timeline of tax relief initiatives.

How did the City come up with this budget?

Chief Financial Officer Sharen Jackson presented the FY 2021 Budget Guiding Principles at the August 4 City Council meeting, sharing the strategy map to deliver on six focus areas: Safety and Security, Mobility, Infrastructure, Quality Development, Partnership and Volunteerism and Performance Management and Service Delivery. Watch the presentation.

“In preparation for the budget, I look at several data sources to help project revenue,” Jackson said. “Using data from the residential and commercial sectors, employment numbers, consumer spending, and the impact from COVID-19, I analyze various economic scenarios to determine what we can expect in the future and make financial projection decisions accordingly.”

Using a modified zero-based budget process, department directors prepare plans to fund the services the city will offer. Proposed expenses are carefully vetted before they are included in the budget proposal.

What is included in the budget?

What is included in the budget?

The budget includes project recommendations from the comprehensive plan and prioritizes CIP projects according to the Master Plans and the City’s ability to fund them. Cash will be used to pay for most of the important capital improvement projects. The City will issue short-term bonds to supplement cash payments.

The amount budgeted for capital projects is $13.7 million. Planned capital improvement projects include improvements for drainage, parks projects like the Southlake Sports Complex improvements, as well as traffic and intersection safety initiatives.

The conservative budget sets up Southlake with an eye towards the future given the COVID-19 pandemic while maintaining essential services like streets, water and sewer, as well as envisioning other projects to make Southlake the ideal place to live, work and play.

What about reducing debt?

The total debt fluctuates depending on projects funded during the year. Since 2010, the City’s property tax-supported debt has been reduced by 69%. The remainder of the current property tax debt obligations will be paid off in less than ten years.

“This is an important gauge of the City’s fiscal health and an important indicator that bond rating agencies review when determining the rating they will assign to city debt,” Jackson said.

The debt reduction prepares the City to handle projects that will require bonds in the future, such as a new library, a potential open space program, CIP projects, and updating the aging infrastructure.

How is the City managing expense growth?

As a practice, the City limits operation budget growth to a benchmark reflective of the consumer price index. This means the cost of existing services shouldn’t exceed the cost growth of services in DFW. For FY 2021, the proposed General Fund budget growth is 1.5%.

Is the City dipping into savings to pay for operations?

Structural balance is a guiding principle to budget creation in Southlake. The City does not draw down from its reserves to pay for operating expenses and projected revenue must cover all planned expenses. Through this mindset, the City has paved the way to achieving optimum reserves and exceed the optimum fund balance to create an opportunity to pay cash for large projects.

What about providing quality services?

The outlined budget aims to continue the Southlake tradition of quality services not only with projects but with hiring and keeping quality public servants. Even with an estimated revenue reduction, the City of Southlake does not anticipate pay cuts or layoffs.

The proposed budget ensures the City of Southlake retains and recruits world-class employees. Under the General Fund accounts, about 70% goes toward labor-related costs. This includes compensation and benefits that are market competitive but holds the line on costs. In 2021, the City proposes a cost of living adjustment of 1.5% consistent with the City’s policy on compensation.

What’s the financial plan during so much economic uncertainty?

Most importantly, the budget presented is sustainable into the future.

Following the financial guiding principles positions the City for budget stability, even during difficult economic times.

“The decisions we make today affect our financial situation in the future,” Yelverton said. “We must provide outstanding service to the community while balancing our ability to pay in the coming years.”

Learn more about the FY 2021 budget at www.CityofSouthlake.com/FY2021.

In the next 7-10 days, property tax valuations for Southlake homeowners will arrive by mail from Tarrant and Denton Counties. And because of all the change due to the COVID-19 social distancing orders, there are also adjustments to this year’s Tarrant and Denton County protest processes.

For Denton County homeowners, the appraisal notice will be mailed by April 29. For Tarrant County residents, notices are scheduled to be sent on May 1.

“For FY 2020, the City reduced the tax rate by 3.7 cents for a valuation of $.041 per $100,” said Sharen Jackson, Southlake’s Chief Financial Officer. “Homeowners also need to make sure their 20% homestead exemption is in place and, if applicable, the senior tax freeze, and an over 65/disability exemption of $75,000.”

Exemptions At Work

To apply for your exemptions, follow these simple steps.

CFO Jackson also said that the 20% homestead exemption for an average valued Southlake home ($740k) reduces the taxable value by $148k, an average a savings of $607.

For FY 2020, the tax rate went from $0.447 to $0.41, which results in additional savings of $222 for homeowners. Most of the rate ($.33) supports general city operations. The other portion of ($.08) pays down on debt that the City has issued to build public infrastructures such as roads, sidewalks, and public facilities. The City tax rate constitutes about 15% of the total tax levy in Southlake (depending on the school district).

Protest Information

Because of current social distancing guidelines, each appraisal district will handle protests differently this year. Both appraisal districts are encouraging residents to use their online protest systems and to create a user profile on the appropriate appraisal site.

If you live in Denton County, click here for Denton Central Appraisal District protest procedures. Denton County residents can create their user profile by using their Google, Facebook, or Twitter account. For more information, visit https://www.dentoncad.com/protestfaqs. The deadline to file a protest with Denton County is 30 days after the postmark on your appraisal notice.

The Tarrant Appraisal District has pulled together a news and FAQ page for property owners. They also advise taxpayers who are preparing to protest to activate their TAD.org online account now. The deadline to file a protest with Tarrant County is June 1, 2020, or 30 days from the mail date listed on the notice, whichever is later.

If you have any questions, please call us at (817) 748-8042. If you prefer to contact your appraisal district directly, the numbers are below.

Tarrant County Appraisal District

2500 Handley Ederville Road

Fort Worth, TX 76118

(817) 284-0024

Denton Central Appraisal District

3911 Morse Street

Denton, TX 76202

(940) 349-3800

For more information about the City’s tax rate, please visit www.CityofSouthlake.com/TaxInformation